Many people hear “grandparents’ rights” and assume grandparents have an automatic right to spend time with their grandchildren. In Minnesota, there is no inherent right to visitation. Grandparents—and certain nonparents—have the right to ask a court for visitation, but they must meet specific statutory criteria and a heightened evidentiary burden before a court can order it.

Minnesota Guardianship Changes in 2024 and 2025: What You Need to Know

Minnesota enacted significant revisions to its guardianship statutes in 2024 and 2025. These changes directly impact guardians – who now face greater potential personal liability – as well as individuals subject to guardianships.

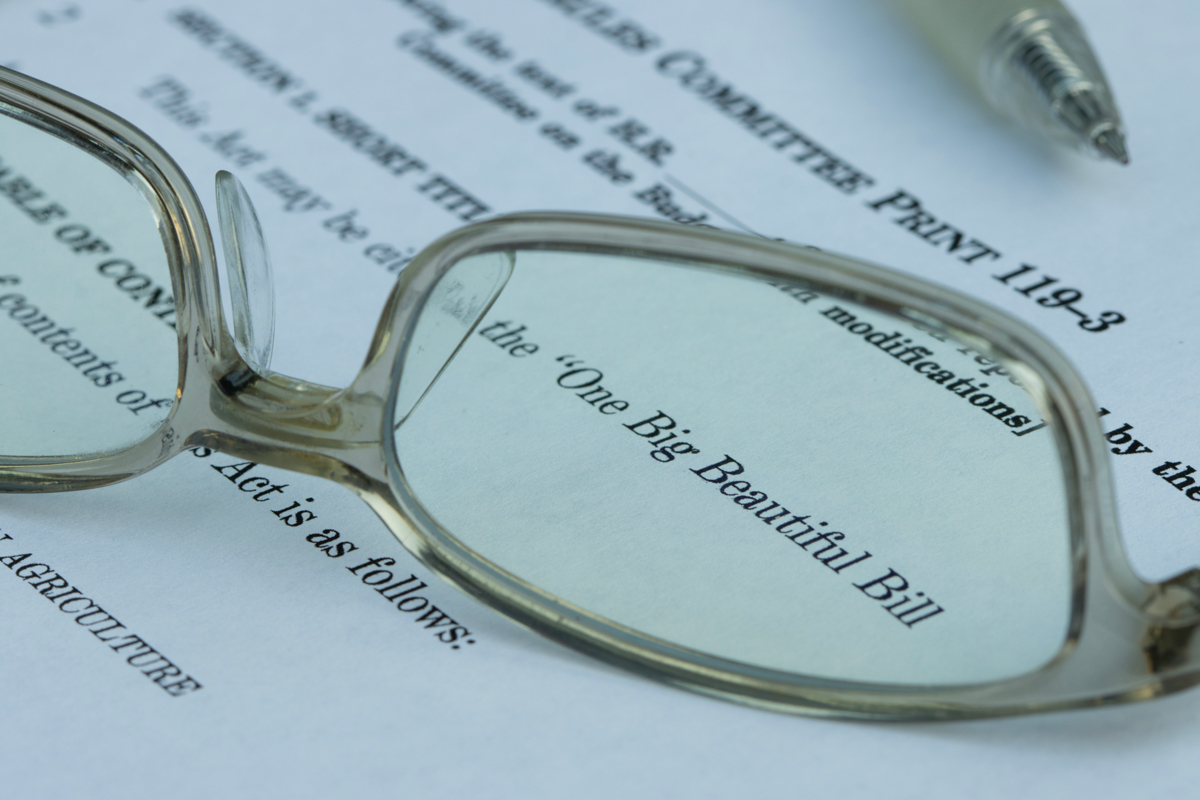

Key Tax Changes Under the One Big Beautiful Bill Act (OBBBA)

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) became law as President Trump penned the final required signature. The OBBBA extends several provisions of the Tax Cuts and Jobs Act of 2017 (TCJA) and includes other changes affecting the taxes of individuals and businesses. Below are summaries of selected tax law provisions.

Minnesota Adopts Changes to Trust and Estate Law, Including 500-Year Dynasty Trusts

In May 2025, substantial amendments to Minnesota’s trust and estate statutes were enacted. Some of these changes include changes to the Uniform Trust Code, the Uniform Probate Code, the Power of Appointment Act, and to modernize Minnesota’s statutory Rule Against Perpetuities. These revisions update the legal framework governing trusts and estates in Minnesota and enhance planning opportunities for multi-generation estate planning.

Understanding Grandparent and Third-Party Visitation in Minnesota

Sarah J. Hewitt | Gina Giambruno

Many people hear “grandparents’ rights” and assume grandparents have an automatic right to spend time with their grandchildren. In Minnesota, there is no inherent right to visitation. Grandparents—and certain nonparents—have the right to ask a court for visitation, but they must meet specific statutory criteria and a heightened evidentiary burden before a court can order it.

Minnesota Guardianship Changes in 2024 and 2025: What You Need to Know

Christopher Burns

Minnesota enacted significant revisions to its guardianship statutes in 2024 and 2025. These changes directly impact guardians – who now face greater potential personal liability – as well as individuals subject to guardianships.

Key Changes Under the One Big Beautiful Bill Act (OBBBA)

Scott Emery

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) became law as President Trump penned the final required signature. The OBBBA extends several provisions of the Tax Cuts and Jobs Act of 2017 (TCJA) and includes other changes affecting the taxes of individuals and businesses. Below are summaries of selected tax law provisions.

Minnesota Adopts Major Changes to Trust and Estate Law, Including 500-Year Dynasty Trusts

Christopher Burns | Scott Emery

In May 2025, substantial amendments to Minnesota’s trust and estate statutes were enacted. Some of these changes include changes to the Uniform Trust Code, the Uniform Probate Code, the Power of Appointment Act, and to modernize Minnesota’s statutory Rule Against Perpetuities. These revisions update the legal framework governing trusts and estates in Minnesota and enhance planning opportunities for multi-generation estate planning.

Minnesota Residential Real Estate Sales: What You Need to Know About Disclosures

Dylan Wallace | John Bisanz, Jr.

Understanding the rights and responsibilities under Minnesota law is crucial for both sellers and buyers to avoid costly real estate disputes. A seller’s failure to disclose known problems – or a buyer’s failure to fully understand what’s been disclosed – can lead to significant consequences.

Are You Ready for Minnesota's New Data Privacy Laws?

J.R. Maddox | Mark S. Landauer

The Minnesota Consumer Data Privacy Act (“MCDPA”) introduces new rights for consumers and new obligations for businesses – and it takes effect July 31, 2025. If your business handles personal information from Minnesota residents, now is the time to prepare. Can you respond to consumer requests under the new law? Are your opt-out tools in place? Have you updated your privacy notice?